XPL

Tokenomics

Understanding XPL

We’re building foundational infrastructure for a new global financial system where money moves at internet speed, with zero fees, and full transparency. Our goal is to bring trillions of dollars onchain, unlocking an open, programmable layer for money itself. XPL is the core asset securing this system. Just as sovereign currencies and central bank reserves underpin traditional finance, XPL safeguards the integrity of this new system and aligns long-term incentives as stablecoin adoption scales. XPL is the native token of the Plasma blockchain, which is used to facilitate and be used in transactions as well as rewarding those who provide network support by validating transactions. XPL is similar in these ways to Bitcoin (BTC) on the Bitcoin blockchain or Ethereum (ETH) on the Ethereum blockchain. We purposefully designed XPL, from mechanics to distribution to partnerships, with a focus on network and campaign incentives designed to scale Plasma’s reach beyond crypto audiences and into traditional financial institutions and legacy systems. By building the network from the ground up, we’ve introduced technical and economic mechanisms that position XPL as a foundational asset with opportunities to drive ecosystem expansion in ways not yet seen in prior network models.XPL Distribution

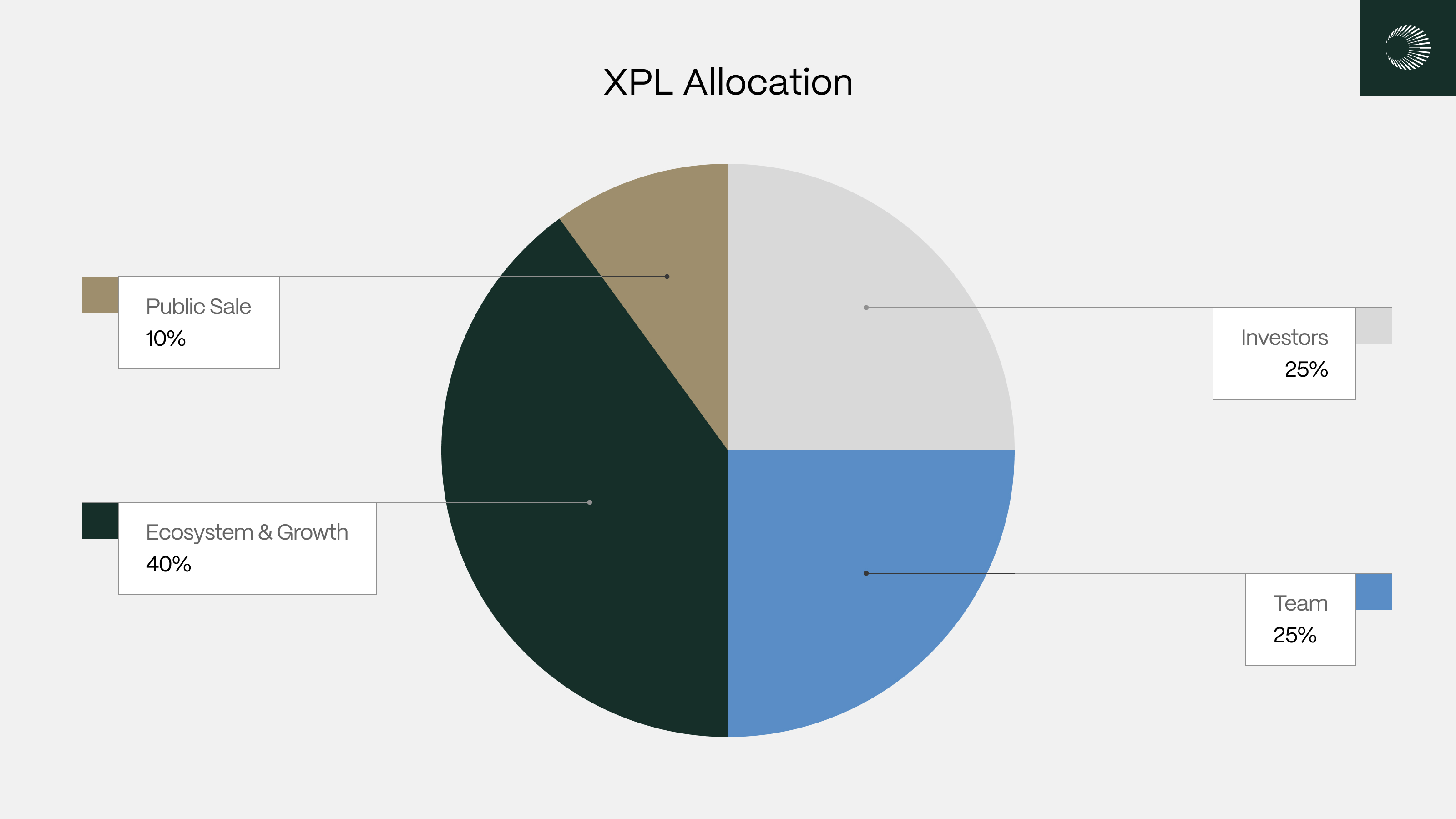

The initial supply will be 10,000,000,000 XPL at mainnet beta launch, with programmatic increases further described in the “Validator Network” section below. The XPL distribution and unlock schedules are as follows.

XPL Public Sale

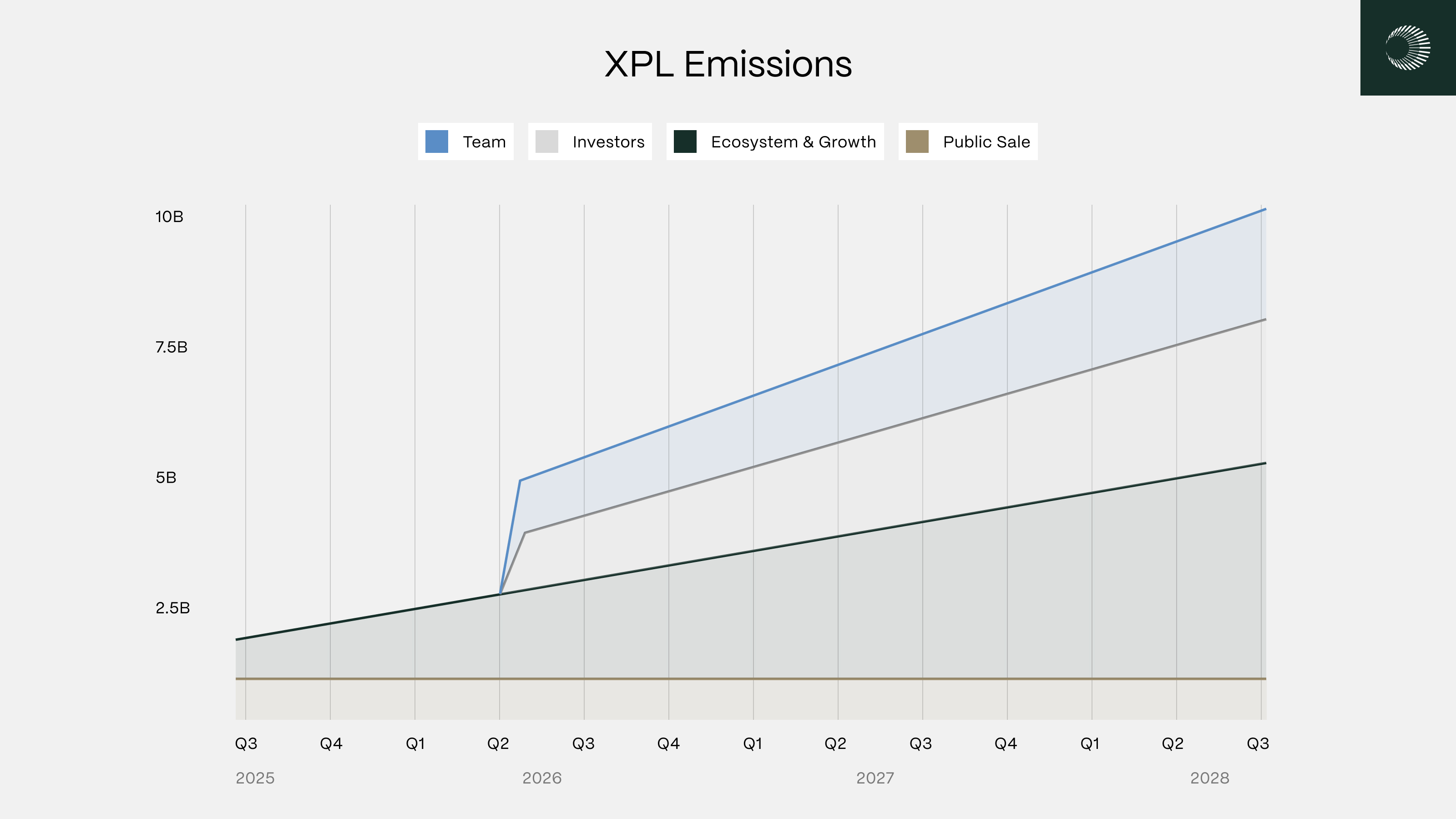

10% (1,000,000,000 XPL) We want to redefine how money moves with you, so earlier this year, we announced the XPL public sale, where 10% of the XPL supply (1,000,000,000 XPL) was allocated to participants in the deposit campaign. XPL sold in the public sale are unlocked as follows:- XPL purchased by non-US purchasers are fully unlocked upon launch of the Plasma public mainnet beta.

- XPL purchased by US purchasers are subject to a 12-month lockup and will be fully unlocked on July 28, 2026.

Ecosystem and Growth

40% (4,000,000,000 XPL) Plasma has an opportunity to rewrite existing financial systems, but it’s admittedly a capital-intensive endeavor. We plan to leverage XPL to intensify Plasma’s network effects, not just in crypto-native ecosystems, but across traditional finance and capital markets as well. While nobody has quite solved the riddle of network adoption, we believe that our streamlined approach in responsibly deploying XPL will contribute to widespread network effects that most crypto-native projects have failed to sustain over the long term. The XPL reserved for Ecosystem and Growth are unlocked as follows:- 40% of the XPL supply (4,000,000,000 XPL) is allocated to strategic growth initiatives that are designed to expand the utility, liquidity, and institutional adoption of the Plasma network.

- 8% of the XPL supply (800,000,000 XPL) will be immediately unlocked at Plasma’s mainnet beta launch to provide for certain DeFi incentives with strategic launch partners, liquidity needs, support exchange integrations, and to implement early ecosystem growth campaigns.

- The remaining 32% (3,200,000,000 XPL) unlocks monthly on a pro-rata basis over the following three-year period, such that 100% of the Ecosystem and Growth allocation is unlocked on the date that is three years from the launch of the public mainnet beta.

Team

25% (2,500,000,000 XPL) Rewriting legacy financial systems requires industry-leading talent and attracting that talent requires long-term incentive alignment. As such, we’ve allocated 25% of the XPL supply (2,500,000,000 XPL) to incentivize current and future service providers. In addition to vesting schedules tied to start dates, the XPL allocated to the team are unlocked as follows:- One-third of the XPL team tokens are subject to a one-year cliff from the date of the public launch of Plasma mainnet beta.

- The remaining two-thirds are unlocked monthly on a pro-rata basis over the following two-year period, such that 100% are unlocked on the date that is three years from the date of the public launch of Plasma mainnet beta.

Investors

25% (2,500,000,000 XPL) In order to build a blockchain infrastructure that will underwrite our mission to rewrite financial legacy systems, we needed to raise capital from the world’s leading investors. As such, Plasma received investments from high-caliber investors such as Founder’s Fund, Framework, and Bitfinex, among others, to support the development of the Plasma blockchain. In addition to high-caliber investors, Plasma has also pushed a community-aligned approach from day 1 with the first Echo sale to private investors in the seed round. XPL sold to investors are unlocked on the same schedule as the team allocation.

Validator Network

Validators provide core infrastructure services underpinning Plasma, a Proof-of-Stake (PoS) blockchain network. In PoS systems, validators stake their own tokens to earn the right to confirm transactions, update the ledger, and receive protocol rewards. By executing transactions and participating in consensus, validators help Plasma maintain a high-performance, censorship-resistant network optimized for stablecoins. Additionally, we plan to implement staked delegation in the future, which allows XPL holders to participate in network consensus by assigning their stake to a validator, earning a share of the rewards without running infrastructure themselves. Validators in a PoS model are rewarded for providing core infrastructure services – participating in consensus and signing blocks – to the broader network.Inflation Schedule

In PoS blockchain networks, validator rewards are typically minted by the protocol itself. Most chains, therefore, introduce a controlled rate of token inflation that acts as a security budget, paying validators for the capital they stake and the computing resources they contribute to the network. When we designed the XPL validator rewards system, we focused on two objectives: (i) keeping validator economics attractive so that the network would be secured by industry-leading participants and (ii) limiting long-term dilution for XPL holders. As such, the rewards mechanics are as follows:- Validator rewards begin at 5% annual inflation, decreasing by 0.5% per year until reaching a long-term baseline of 3%.

- Inflation only activates when external validators and stake delegation go live.

- Emissions are distributed to stakers via validators. Locked XPL held by the team and investors are NOT eligible for unlocked rewards.