Why Build on Plasma

Overview

TL;DR

- Purpose-built for stablecoins: Native support for zero fee USD₮ transfers, custom gas tokens, and confidential payments

- High-performance architecture: Pipelined Fast HotStuff consensus with a modular EVM execution layer built on Reth

- Bitcoin-native: Trust-minimized bridge for real BTC with direct cross-asset programmability

- EVM compatible: Use existing Solidity tooling with no changes required

- Integrated infrastructure: Card issuance, on and offramps, and compliance tooling available through trusted partners

- Deep liquidity: Launching with over $1 billion in USD₮ available from day one

Why Build on Plasma

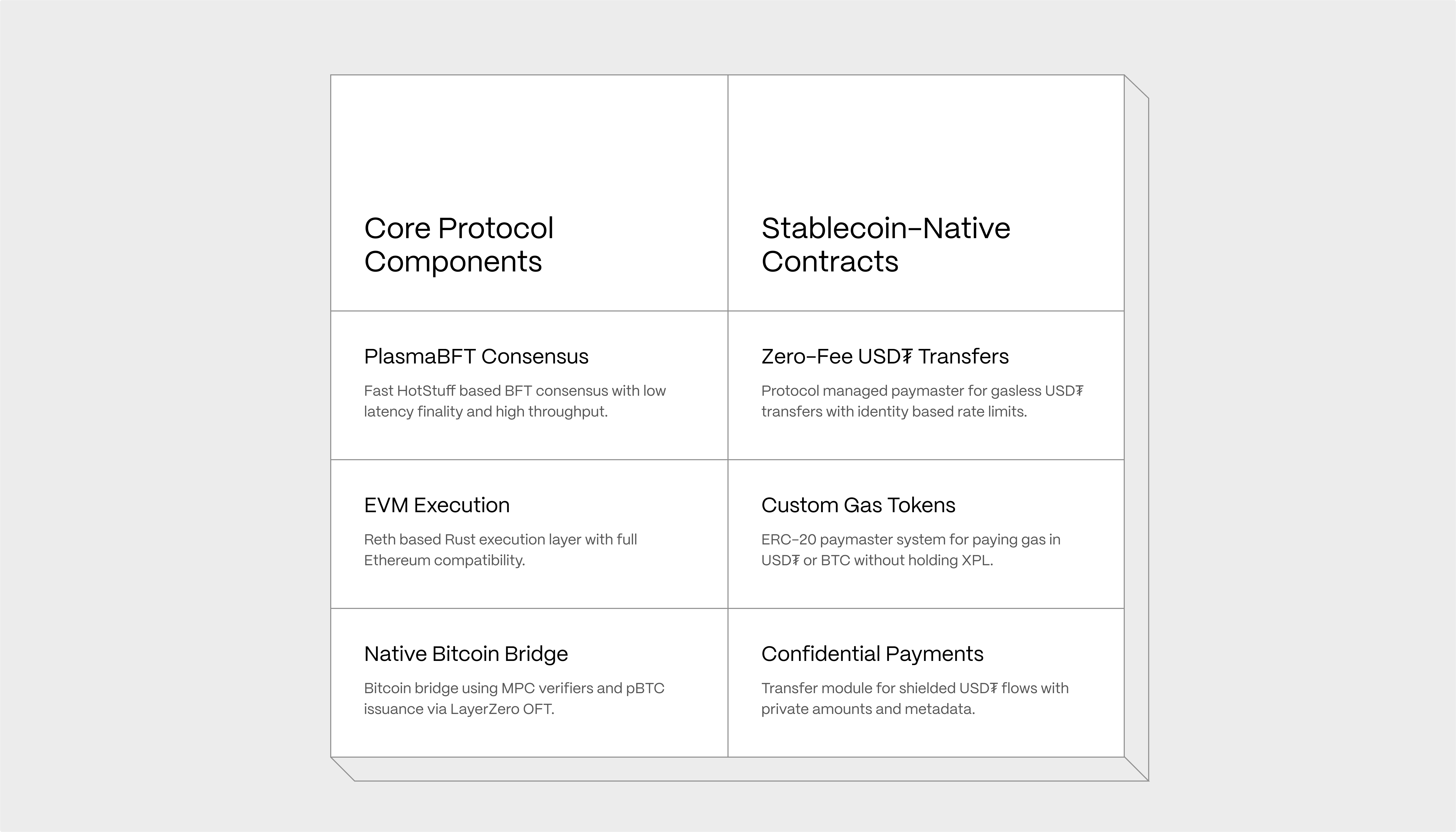

Plasma is a Layer 1 blockchain purpose-built for global stablecoin payments. It combines high throughput, stablecoin-native features, and full EVM compatibility, giving developers the foundational infrastructure to build next-generation payment and financial applications. Developers can deploy applications and protocols using the tools they already use, including Hardhat, Foundy, and wallets like MetaMask. Plasma also provides protocol-maintained contracts for zero fee USD₮ transfers, custom gas tokens, and confidential payments. These features are scoped for stablecoin use cases and integrate cleanly with EIP-4337 and EIP-7702 smart accounts. While not yet embedded at the protocol level, they are designed for deeper coordination with block building and execution over time. Whether a developer is building anything from a wallet to an FX system or a consumer application, Plasma gives them the speed, liquidity, and flexibility to operate at global scale.Design Philosophy

Plasma is built around a simple principle: stablecoins deserve first-class treatment at the protocol level. Instead of relying on middleware or external wrappers, Plasma provides native tools for cost abstraction, privacy, and programmable gas. These tools are usable out of the box and are designed to integrate more deeply over time with the chain’s execution logic. The result is a developer experience that is simpler and more robust with fewer dependencies, faster iteration, and stronger guarantees. All while remaining fully compatible with the EVM ecosystem.

Architecture Overview

Plasma is built around three core architectural components:1. PlasmaBFT Consensus Layer

PlasmaBFT is a pipelined implementation of the Fast HotStuff consensus algorithm. Unlike traditional designs that process each stage sequentially, Plasma parallelizes the proposal, vote, and commit process into concurrent pipelines. This increases throughput and reduces time to finality. Finality is deterministic and typically achieved within seconds. The protocol maintains safety and liveness under partial synchrony and provides full Byzantine fault tolerance. This consensus design is optimized for stablecoin workloads, with high transaction volume, low latency, and consistent performance under global demand.2. EVM Execution Layer

Plasma’s execution environment is fully EVM compatible and built on Reth, a high-performance, modular Ethereum execution client written in Rust. Developers can deploy contracts using standard Solidity with no modifications from Ethereum mainnet. All major tooling is supported out of the box, including wallets, SDKs, libraries, and developer frameworks. There is no need for bridging layers, custom compilers, or modified contract patterns. Plasma combines predictable execution with full compatibility, making it straightforward to build and scale EVM-native applications.3. Native Bitcoin Bridge

Plasma includes a trust-minimized Bitcoin bridge that allows BTC to be moved directly into the EVM environment. The bridge is non-custodial and secured by a network of verifiers that will decentralize over time to validate Bitcoin transactions on Plasma without centralized intermediaries. Bridged BTC can be used in smart contracts, collateral systems, and cross-asset flows. Users retain control of their funds while gaining access to programmable Bitcoin onchain. This enables BTC-backed stablecoins, trustless collateral, and Bitcoin-denominated finance within a single environment.Stablecoin-Native Contracts

Plasma maintains a set of protocol-governed contracts tailored for stablecoin applications. These contracts are tightly scoped, security-audited, and designed to work directly with smart account wallets. They are managed by the Plasma Foundation and evolve alongside the protocol. Over time, they are intended to integrate deeper into the execution environment, with support for prioritized transaction inclusion, native runtime enforcement, and protocol-level incentives. These contracts are usable out of the box and composable with account abstraction standards such as EIP-4337 and EIP-7702.1. Zero Fee USD₮ Transfers

Plasma includes a dedicated paymaster contract that sponsors gas for USD₮ transfers. The contract is restricted totransfer and transferFrom calls on the USD₮ token. It does not support arbitrary calldata, ensuring predictable behavior and reducing attack vectors.

Eligibility for sponsorship is determined using lightweight identity verification (such as zkEmail) and enforced rate limits. Once approved, gas is sponsored from a pre-funded XPL allowance managed by the Plasma Foundation.

This allows developers to offer seamless, fee-free transfers to end users while maintaining strict cost control and blocking spam.